Finding high yield opportunities in a low-interest environment is quite the challenge. However, our low-risk investing approach focuses on safe, high dividend stocks that can weather any kind of storm that might come our way…

For the past two decades, we have spent the better part of our time as financial analysts finding the right opportunities for our most conservative clients. The majority of our clients have always been those close to or already in retirement. They are typically over age 50 and looking for the perfect blend of growth and Income.

Over the years, we have created a special way to protect their money in this volatile market, while adding consistency and quality to their portfolios. We help them sleep well at night knowing they have rock -solid investments that are helping to maintain their standard of living as we grow their income year after year.

Our strategy is designed to bring generous dividend checks like clockwork each and every quarter. It may sound boring, but it takes a lot of old-fashioned hard work to be able to deliver consistent results.

Believe it or not, high-dividend-paying stocks have actually contributed 44% of the S&P’s total return over the past 80 years. Dividend stocks are like the Holy Grail of investing. Yet, many investors choose bonds for income over quality dividend paying stocks and this is often a huge mistake.

Let’s go all the way back to January of 1990 for an example. 1989 had been a tough year. There had been a recession, inflation was at 5.1%, and economic growth had come to a screeching halt. The Fed decided to raise rates to combat inflation also slowed the economy down. By 1990, economic trouble continued with the Gulf War, which would lead to massive spikes in oil prices. So, investors were nervous to say the least with high unemployment, massive government budgetary deficits, and slow Gross Domestic Product (GDP) growth.

Interest rates were hovering around 8%.

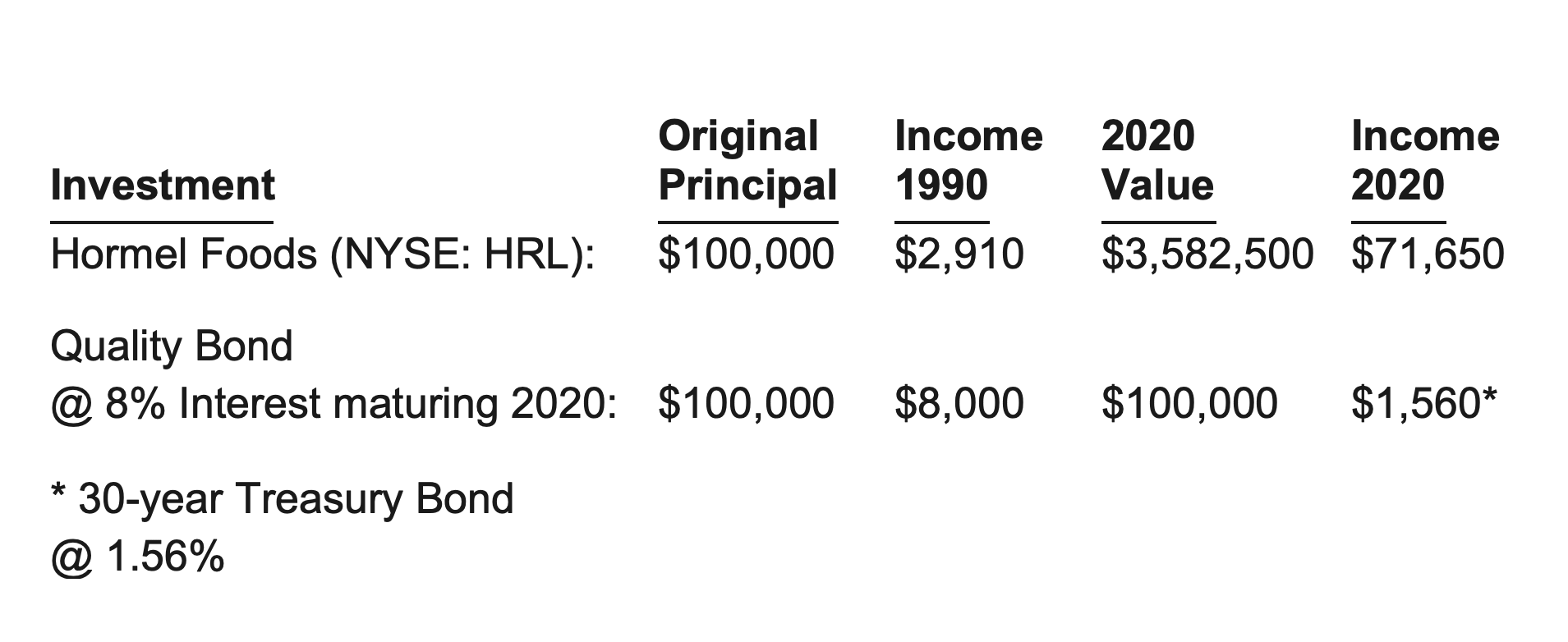

Let’s say you were afraid of the markets and decided to forgo the stock market and instead sought safety in the bond market. In 1990, you could have bought $100,000 of a quality bond paying 8%, which would mature in 2020 (30-year bond). You would have received $8,000 a year for the past 30 years and then receive your original $100,000 back at maturity in 2020. Not too shabby!

However, what if instead you decided to place your money in a quality dividend paying stock and hold the stock just like the bond all the way until 2020?

What kind of stock would you pick? As an example, let’s pick one of my favorite sectors, which is the food industry. Think about it: people need to eat no matter what the economy is doing and the global population keeps growing! And one of the most sought-after foods is meat. Of the meat companies, one of our favorites is Hormel Foods (NYSE: HRL). Now this is a classic rising dividend stock.

If you chose to buy $100,000 worth of Hormel on January 2, 1990, it would have provided $2,910 a year of income, with a yield of about 3%. This provided much less income in 1990 than the 30-year bond. However fast forward to 2020 and you will be amazed at the difference:

As you can see, the dividend stock grew the investors income AND substantially increased their capital as well. The bond investor enjoyed a steady 8% income for 30 years, but was in shell shock when they had to renew their bond at a measly 1.56% when the bond came due. Dividend stock investing can provide an income that keeps pace with inflation and grows your family wealth!

There are countless stories of hard working folks who amassed fortunes simply by investing in high quality dividend paying stocks. Remember the secretary at Abbott Labs. (NYSE: ABT) who bought her company’s stock in 1935? If you haven’t heard this story, she collected and reinvested her dividends for 75 years, all while amassing a $7 million fortune! You might not have heard this exact story, but surely you have heard of one where someone is getting paid thousands or even millions of dollars in dividend income.

We have seen school teachers and fire fighters and telephone workers who never made huge incomes now getting paid more in dividend income while retired than they ever earned while working. Think about that – earning more income in retirement than you earned while working. This is a huge shift: Instead of working hard for your money, your money is working hard for you!

Not all high dividend stocks are created equal!

Sometimes companies have very attractive dividend rates. This can often be for a number of dangerous reasons. A company could be paying out too much income and be unable to sustain its current revenue trend or maybe the company’s stock price has fallen significantly and it still pays the same dividend. Either way, both companies are in high danger of cutting or eliminating their dividends.

Introducing our five-step analysis process:

We instead, want to focus on high quality companies that meet our five metrics:

- Strong Relative Strength: We look for companies performing in-line with the market or better.

- Attractive Yields: We look for stocks with an above average dividend yield (3% or greater).

- Reliable Dividends: We fully examine the length and consistency of a company’s dividend payouts. We also look for companies that have a high probability that they will continue payouts in the future.

- Stable and Increasing Dividend Payments: We look for companies that have a history of stable and increasing dividend payouts.

- Increasing Earnings Growth and cash flow: We look for companies that have a trend of increasing earnings as this shows a company is earning more and can sustain and possibly increase its dividend. More importantly, we look for companies that have been increasing their free cash flow.

Enron, WorldCom, and other great collapses have shown us that profits and earnings can be manipulated. However, cash flow (money coming in and out of a company) tells the true story of what’s really going on. This is the very pulse of EVERY single company.

Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value. It is the money used for research and development, acquisitions, expansion, and the money used to reward investors through share buybacks and dividend payments.

In finding the right high dividend stocks I look for those with an increasing trend of Free Cash Flow (FCF). This helps me find stocks that have the potential to grow earnings, further reward shareholders, and best yet – outperform the market!

This five-step process helps us discover a rare breed of dividend stock that can sustain its performance well into the future and provide you with above average income to potentially outpace inflation:

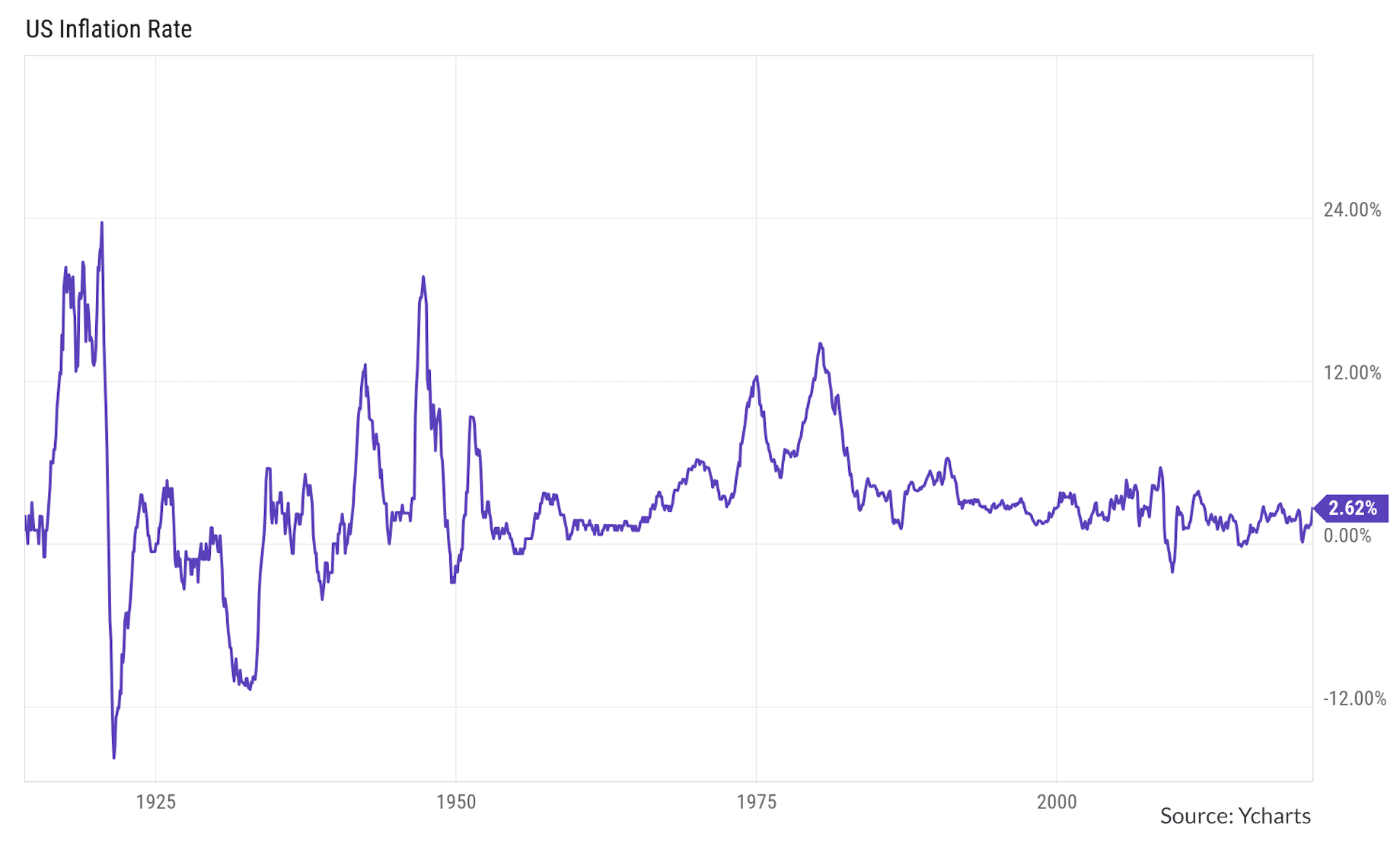

Fixed income instruments may look a safe bet with their “guaranteed” income. However, when you look closer they are “guaranteed losers” because they offer 0% income growth and aren’t keeping pace with inflation and taxes!

Over the past ten years, the rate of inflation has been around 2%, yet look at your fixed rate investment choices:

- Money market accounts paying next to nothing

- Certificates of Deposits (CDs) not paying much more.

- Treasury Notes (T-Notes) failing to keep up with the Consumer Price Index (CPI)

Today, the average S&P 500 dividend payment is a little over 1.4%, which still doesn’t keep up with inflation. What if instead you could have an average dividend yield of 4% or more in consistent stable companies?

Right now, it is the perfect time to find great companies that are writing big paychecks. Corporate America is holding more cash than ever before. You just need to find the right companies and that’s where we come in…

We help you find solid companies that pay above average dividends where we are highly confident they will continue to pay them quarter after quarter.

We use our five-step process to find companies likely to pay sustained and increasing dividends…and also have strong prospects for growth as well.

This is a safer, long-term, income approach that offers you a strong mix of dependable investments with limited fluctuations.

Included in our Global Income Portfolio are a diverse group of income investments such as:

- Income stocks that pay at least a 2% dividend: We look for stable companies in stable industries that typically have lower volatility while paying strong rising dividends.

- Real estate investment trusts (REITs): REITs offer investors an opportunity to gain access to a real estate portfolio without the headache of being a landlord. REITs typically include high-quality commercial properties, ranging from apartment buildings and office complexes, to health care facilities and shopping malls. Because REITs have no investment minimums, they allow large and small investors an easy way to participate in commercial real estate. The best part: REITs must pay out 90% of its operating profits as dividends in order to be exempt from having to pay corporate income taxes. As a result, most REITs pay frothy dividends.

- Master limited partnerships (MLPs): Investors keep searching high and low for better yields, but many miss the boat on MLPs. Few investors have a good knowledge of MLPs, because they have the stigma of being too mysterious and complex. But investing in MLPs isn’t that difficult. Like a traditional stock, these investments trade on public exchanges and have outperformed the S&P 500 over the past 20 years. Many MLPs are pipeline businesses making money from the processing or transport of oil, natural gas or coal. Thanks to strict environmental regulations, they don’t face much competition. And because they transport these commodities rather than explore them, they are theoretically less affected by ongoing volatility in commodity prices.

- Business development companies (BDCs): A BDC is a form of publicly traded private equity that loans money to small and upcoming businesses. In return for taking the risk of loaning the money, these startups pay the BDC interest, often also offering an equity stake. Because they are required to pay regular dividends, income from BDCs is generally more stable than that of regular stocks, especially during the ups and downs of the economy. They also have a diversified asset base, typically consisting of a portfolio of 50 or more loans/equity. Because of this nature, BDCs have plenty of capital available for growth.

- Preferred stocks: These stocks tend to pay sizable dividends typically greater than those of common shares. They have characteristics of debt instruments as well as equities. One of the major advantages of a preferred stock is the priority dividend payout. This means preferred shareholders get dividends before the common shareholders. Dividends payout on preferred stock is very similar to coupon payments on a bond. Preferred stocks don’t have a maturity date like bonds, but they do have a par value, which is used to figure out the payouts.

On rare occasions, the portfolio service might even recommend going short to take advantage of bearish market conditions or using other hedging vehicles to protect against downturns. We help provide you with the what, when, and why of every recommendation we make to provide you with steady, inflation-beating income opportunities. Not only do we provide recommendations, we also track, choose, and monitor each investment with precision and care.

Here’s a look at how we make our selections:

- We create a universe of 200-300 stocks that have good prospects for earnings growth and have great upside potential going forward.

- We then apply a set of stringent screening criteria to find companies with strong balance sheets.

- We narrow our universe down to stocks with dividend yields of 2% or better.

- We focus on payment ratios that are generally less than 70% unless they are an MLP or REIT, which may be legally required to pay out more. This ensures that a company is retaining enough revenue to reinvest for future growth.

- We screen out investments that have cut dividends over the past five years.

- We then focus on diversification making sure we cover enough sectors and have a good group of companies.

How has the strategy performed?

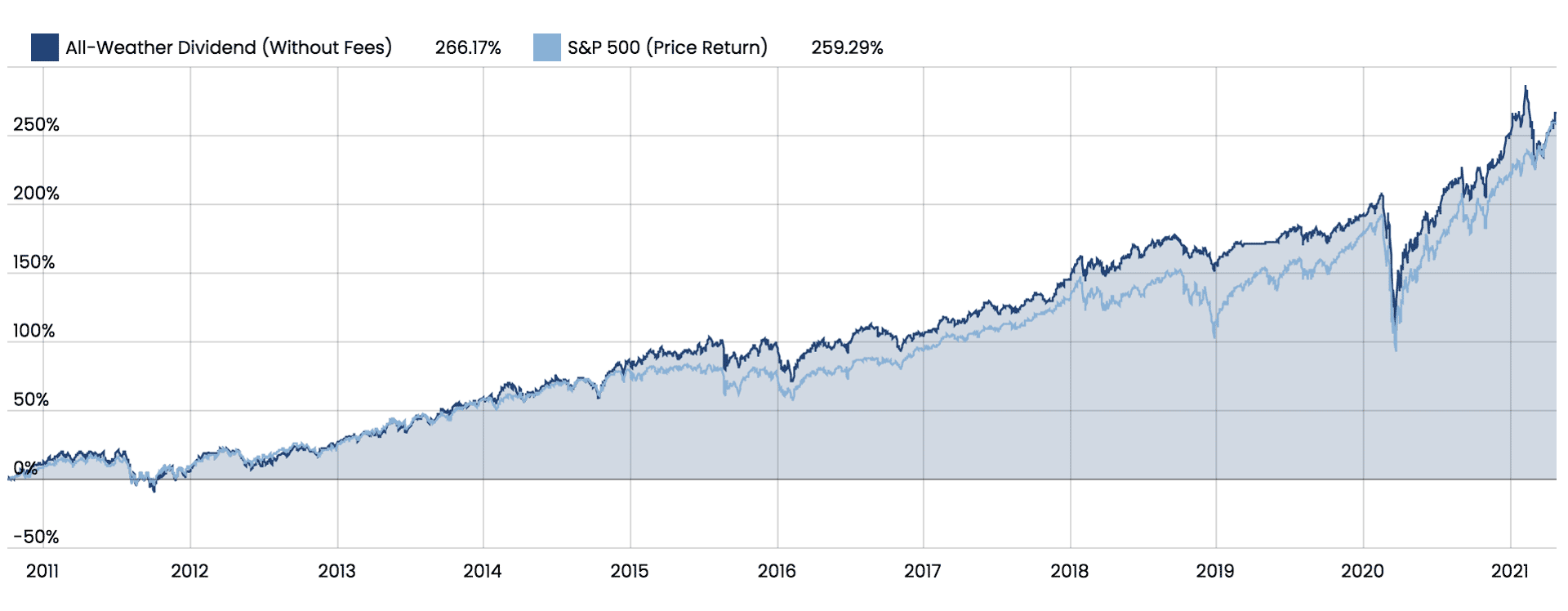

Since 2013, the strategy is up over 193%!

The average dividend yield is

Additionally, we use faith-based screens to make sure they are companies that line up with Christian values.

We use a four-step process:

- Avoid companies that violate your faith and values. Some of the types of companies we can avoid include those involved in:

- The abortion industry

- Producing explicit entertainment and pornography

- Embryonic stem cell and fetal tissue research

- Homosexual activism

- Producing alcohol and tobacco

- The gambling industry

- Environmental abuse

- Seek out those companies that complement your faith and values. This involves finding companies:

- Helping the poor and defenseless

- Protecting the sanctity of human life

- Producing morally sound entertainment

- Finding cures for life threatening diseases

- Improving society and the world around us

- We seek investments with strong financial potential. We examine the up and downside potential of every investment, looking for companies with low debt, attractive valuations, growing earnings, strong management/leadership, in growing sectors of the economy (to name a few).

- We seek to help you diversify your holdings. This involves buying stocks, bonds, alternative investments like gold, silver, and oil, and cash investments. By diversifying your risk, we help you gain peace of mind and potentially higher rates of return.

As a Global Income Portfolio member, you’ll be alerted when the time is exactly right to buy the next opportunity. There will always be 20-25 ideas ready for you to take action on. Don’t miss out!

Today, you can go above and beyond standard dividends, and generate a higher income with low risk. Get started today!

The portfolio has returned over 266% since 2010, beating the S&P 500 with lower risk!

Who is this service right for?

Investors interested in:

- Strategies for short-term and long-term investing.

- Value and growth opportunities.

- Fundamental and technical analysis.

- Stable income investments and growth stocks.

- Large cap, mid cap, small cap, and global companies.

Gain access to all of our research and portfolio recommendations designed to help you reach your goals.

Here’s what you get:

Each month members receive:

- Get 24/7 Real-Time Access to our latest research and portfolio recommendations.

- Receive instant BUY and SELL alerts directly in your email inbox every time we make a change to the portfolio

- Get monthly portfolio briefings from Anthony Wright & Jay Peroni, CFP

- Just $499 per year or $50 per month

Don’t miss your chance to gain access to all of our strategies that are designed to make money for you, regardless of market direction, regardless of volatility.

We offer a full 30-day money-back guarantee on the All-Weather service. If you are dissatisfied for any reason, simply contact us within 30 days for a 100% refund!

SIGN UP NOW!

Best Value!

See you on the other side!

Sincerely,

Anthony Wright, Senior Analyst & Jay Peroni, CFP

Global Income Portfolio (GIP) leverages low volatility companies around the world in search of the best dividend-paying stocks for the long haul. You get income-producing investments with strong performance, less ups and downs, and lower risk.