How to find tomorrow’s most profitable stocks before Wall Street finds them!

Faith-Based Small Cap Stocks You Can Believe In!

Many investors are searching for a place to find stocks that can turn a nest egg into a huge fortune…

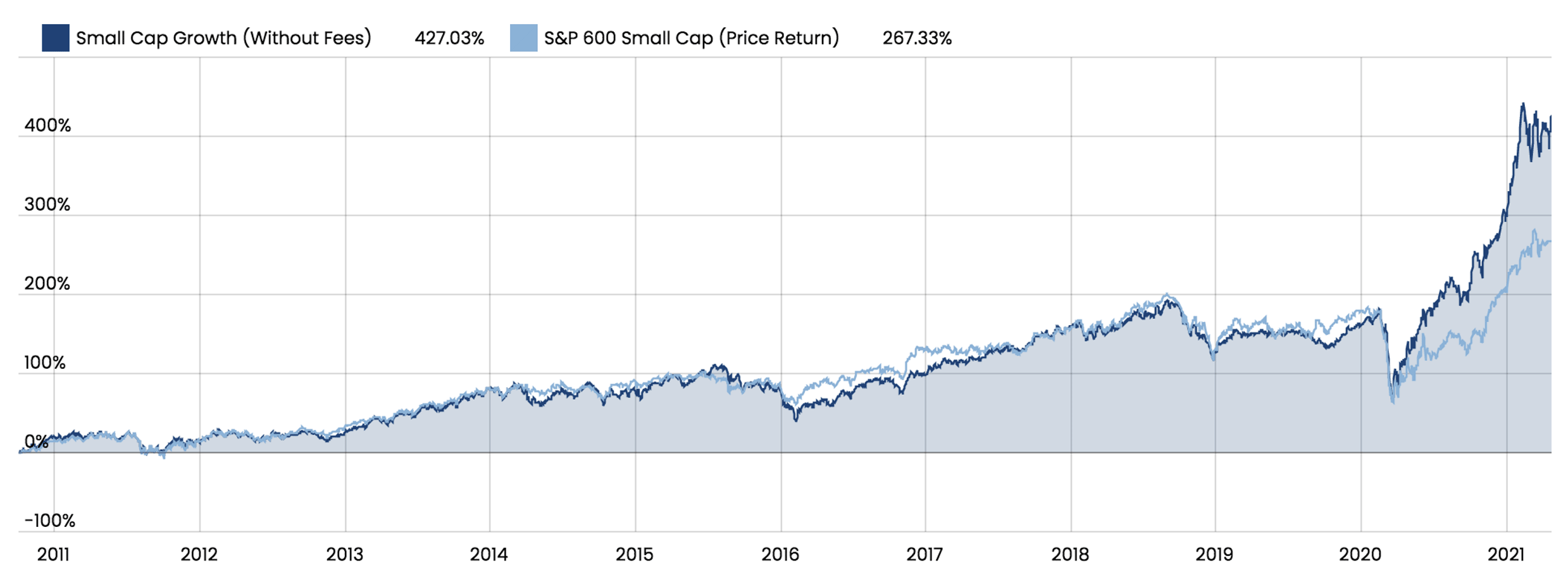

Since 2010, the Lion’s Path Small Cap Portfolio has produced annualized gains over 40% per year, turning a $10,000 portfolio into $52,703!

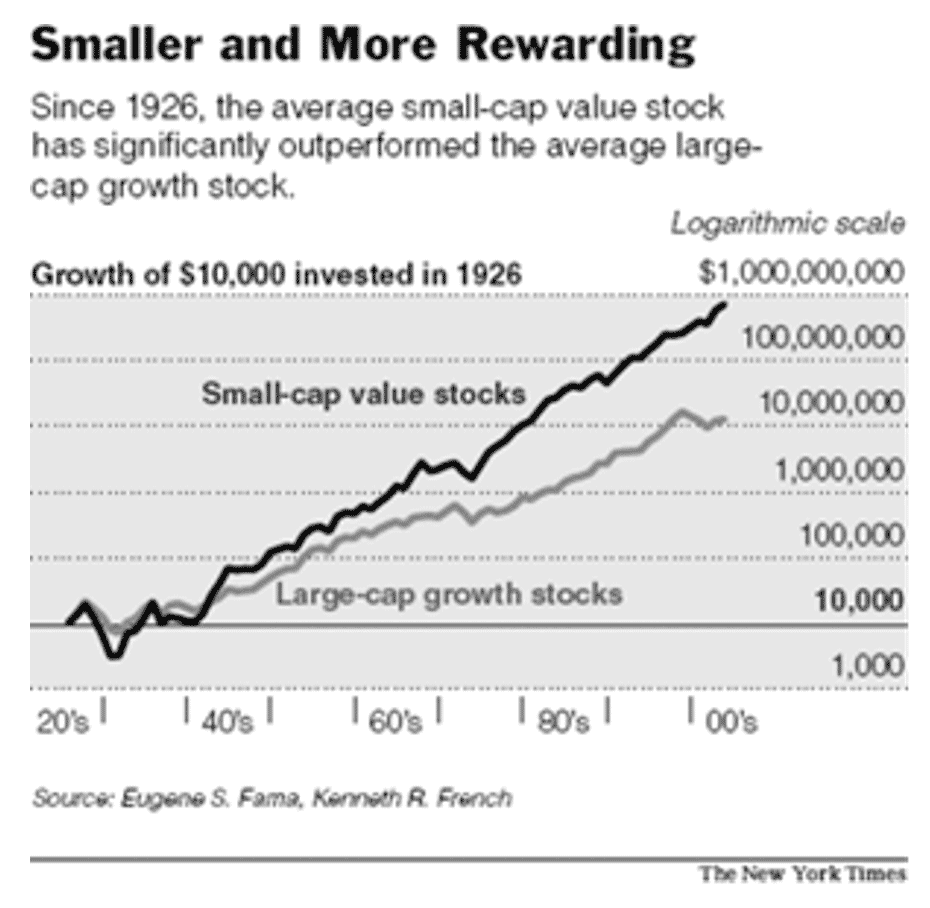

Small cap stocks ($250 million to $3 billion) have had an impressive run over the past 95 years. In fact, small cap stocks have produced 12.1% annualized returns compared to 9.9% annually for large-cap stocks (over $10 billion), according to research from Ibbotson Associates.

Now this may seem like just a measly 2.2% each year, but the compound effect over the years is astonishing!

Consider this:

- $10,000 invested in large cap stocks in 1926, would be worthover $30 million today…

- $10,000 invested in small cap stocks in 1926 turns into over $160 million today…

- Even more amazing is the small cap value category, $10,000 invested in 1926 becomes more than $900 million today

Simply put, if you want to build a fortune over the next decade, you must invest in small-cap stocks. In fact, all ten of the top-performing stocks of the past decade were small cap stocks. Chances are the top-performing stocks over the next decade will also be small cap stocks.

How can you build a fortune?

There is no get rich quick formula, but good old-fashioned discipline, hard work, and a thorough research process can pay HUGE dividends.

That is why the Lion’s Path Small Cap Portfolio was created to help you find the best small-cap stocks today. By investing in underfollowed companies before Wall Street analysts catch on, you stand to make substantially higher gains as the market drives up share prices.

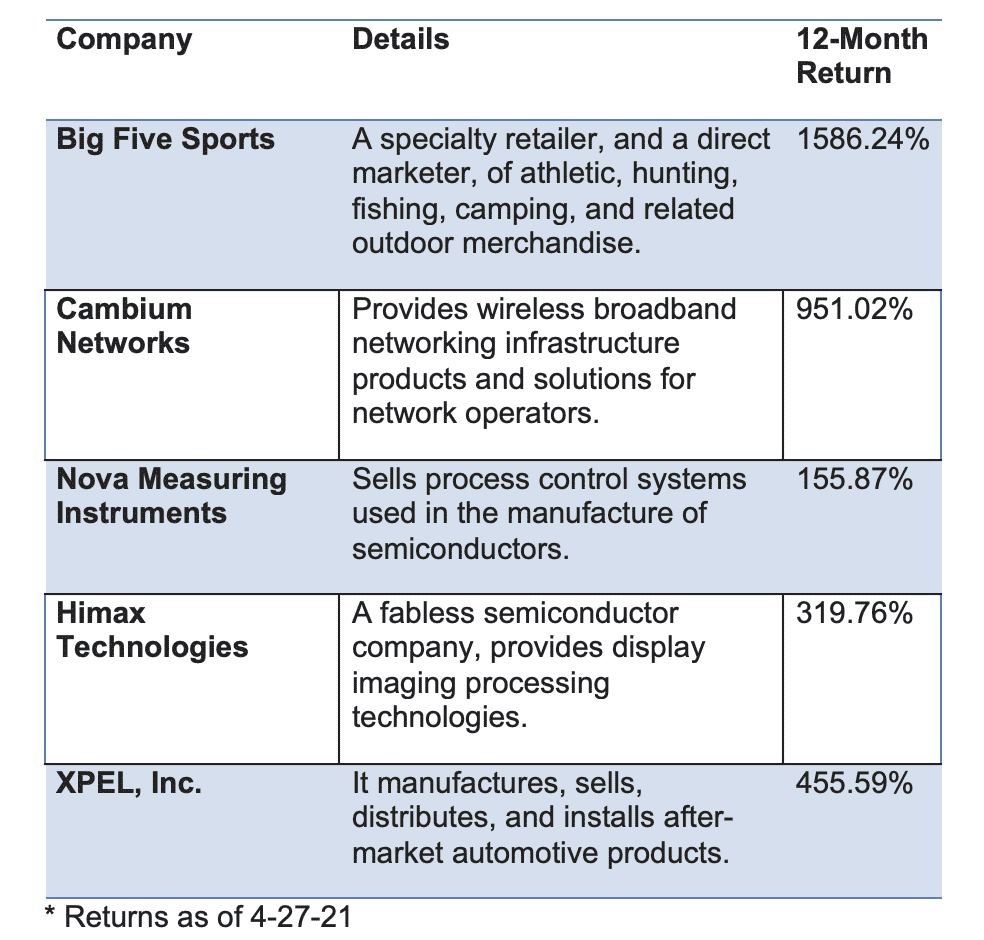

This has proven to be a path toward success. Here is a small sample of some of our stock selections:

Why small caps now?

There are two very powerful forces in motion as we speak:

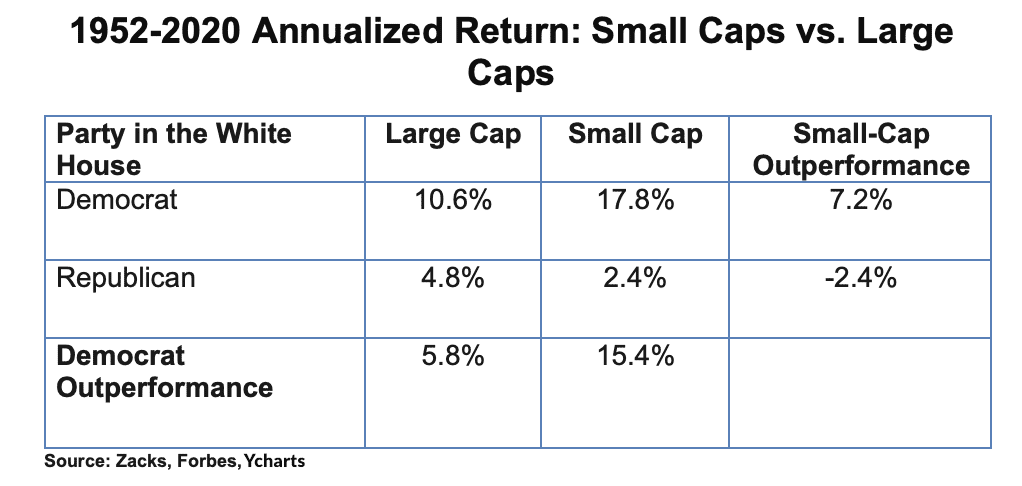

POWERFUL FORCE #1: The U.S. recently elected a Democratic President to a four-year term. Stocks generally perform better during Democratic presidencies and small caps tend to outperform large caps during these periods.

One look at history and you will see what I mean:

POWERFUL FORCE #2: The Federal Reserve’s money-printing program which consists of “quantitative easing” and “covid relief” should lead to higher inflation and stronger economic growth.

Small cap stocks tend to outperform during inflationary times because they tend to offer unique products with less competition and more flexibility to raise prices than their larger cap counterparts.

Think back to one of the most inflationary periods ever – the 1970s. During the 1977-79 peak large-cap stocks were stuck in neutral while small cap stocks took off like a rocket!

Furthermore, if we look at the six major inflationary periods since World War II, which included such events as the Korean War, OPEC oil crisis, the Vietnam War, and let’s not forget the Persian Gulf War, small cap stocks were up 82.6% during these periods versus just 35.1% for large caps. That is almost 3 to 1!

The bottom line is this: Small cap stocks are much more sensitive to changes in political and monetary conditions and could be the perfect place to be right now as an investor!

By seeking out well-managed companies with unbeatable products or services whose stocks are undervalued or unknown by most investors, you have the potential to CRUSH the markets over the next 3 to 5 years and make a potential fortune along the way…

We use a faith-based approach screening each company to make sure it doesn’t violate any of our biblical value screens:

- Abortion

- Pornography

- Embryonic Stem Cell Research

- Explicit Entertainment

- Vices like Tobacco, Alcohol, and Gambling

- Human Rights Violations

Instead, we seek our companies making a positive impact on society, companies with strong, robust sales and earnings growth. These are the types of companies that can quickly growth your retirement portfolio.

Each month Small Cap members receive:

- Get 24/7 Real-Time Access to the Lion’s Path Small Cap Portfolio

- Receive instant BUY and SELL alerts directly in your email inbox every time we make a change to the portfolio

- Download our 15 page special report entitled: “How to Make it BIG with Small Cap Stocks” ($47 Value!)

- Get monthly portfolio briefings from Anthony Wright and Jay Peroni, CFP

GET STARTED NOW TO LEARN HOW TO CRUSH THE MARKETS!

GET SMALL CAP STOCK IDEAS FOR ONE YEAR FOR THE LOW PRICE OF ONLY $499!

Or $50 per month.

We offer a full 30-day money-back guarantee on the Small Cap service. If you are dissatisfied for any reason, simply contact us within 30 days for a 100% refund!

Best Value!

See you on the other side!

Sincerely,

Anthony Wright, Senior Analyst & Jay Peroni, CFP